Have you ever been given an insurance policy illustration and been totally confused by the mountain of information presented to you?

Fret not! In this article, we cover the 3 most important things to look out for in your policy illustration. Specifically, we will be covering policy illustrations for Participating products in this article, using an illustration from NTUC Income’s Gro Power Saver as an example.

To understand what a Participating Product is, check our post here.

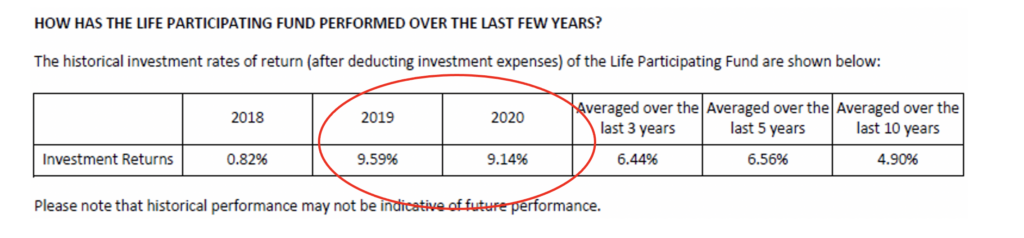

1. The insurer’s past investment performance

The returns on your Participating product are driven by the overall financial performance of the Participating Fund. (We explain the intricacies of Participating Funds in another article here) However, one of the most important factors will be the Fund’s investment performance.

You will be able to view the Fund’s historical performance in Page 2 of your policy illustration:

In this example, NTUC Income had performed very well in 2019 and 2020. Less so in 2018.

Note that its performance over the last 3, 5 and 10 years is well over 4.25% p.a. which is the expected return on which the benefits are illustrated on in the later pages.

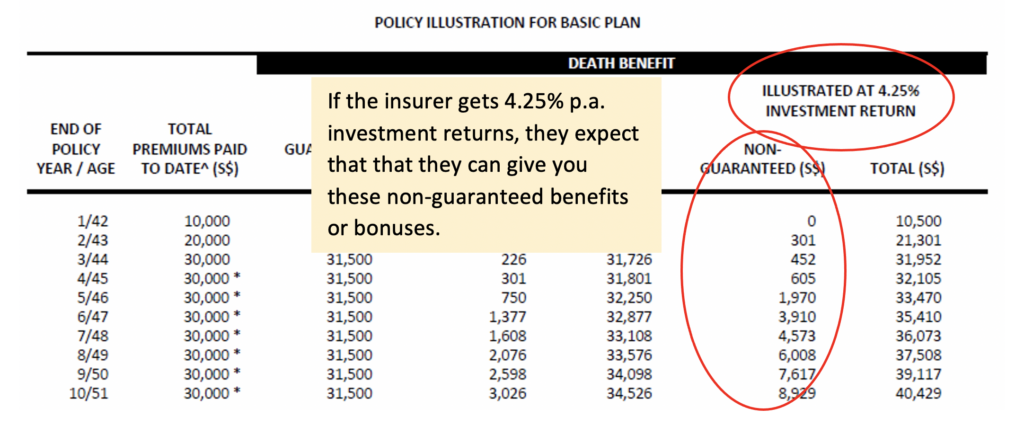

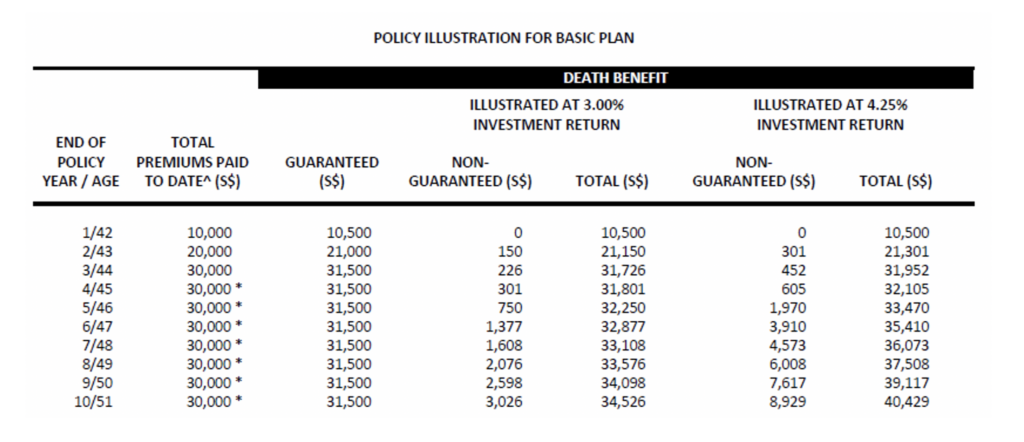

2. The plan’s death and surrender benefit

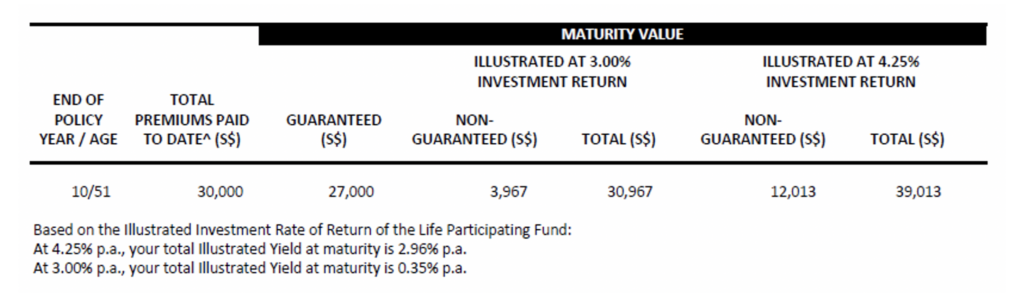

This is where the 4.25% p.a. return comes in! Many may be confused by the reference to 4.25% and 3% which are shown above the benefit tables in Page 5. These are NOT the returns that you get on your policy. These are the returns that the insurer has assumed that they get when projecting the future non-guaranteed benefits. Each illustration will also show a down-side scenario where the insurer earns a 3% p.a. return.

Now, let’s get to the benefits shown.

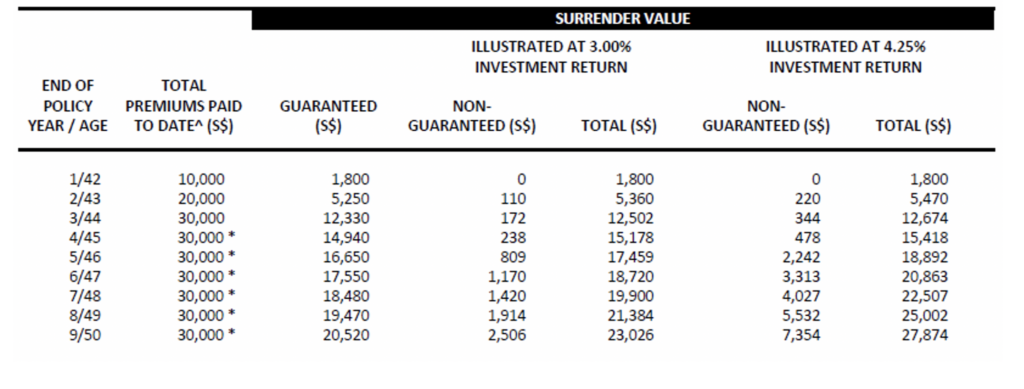

In Page 5 and 6 of your policy illustration, you will see the death, surrender and maturity benefit tables.

For a Participating policy, you will always see a split between the guaranteed benefits and the non-guaranteed benefits. So even if the Insurer has a bad year and decides not to declare any bonuses (this has happened in rare cases under extreme investment scenarios), you will still get the guaranteed benefit. For example, if the insured in this example passes away in the 6th policy year, his beneficiaries will get a guaranteed amount of $31,500 and an expected non-guaranteed benefit (bonus) of $3,910. The total will be $35,410.

As you can see, you really should not surrender your policy as you will not be able to get all your monies back if you surrender your policy early. The assurance that you get from this policy is that you will have a minimum guaranteed amount back and you will not lose your entire investment.

NTUC Income’s Gro Power Saver is designed to be a savings plan, so one of the more important benefits is the maturity benefit. In this case, the policy will pay out $39,013 at the end of the policy term. As shown under the maturity table, the yield at maturity is 2.96% p.a.. (Do note that with InsureDIY’s cashback promotion you could get up to 3.04% p.a.. Check out the details here.)

3. Does the plan have any riders?

Many Participating plans allow you to add riders to enhance the insurance coverage. In the case of NTUC Income’s Gro Power Saver, you can add the Cancer Premium Waiver which waives future premiums on the policy for the remaining term of the rider upon diagnosis of any one of the major cancers after one year.

Typically, you would be shown the premium schedule for the riders if these have age dependent premiums.

It is important to read the details over the riders that you include. In this example, Page 21 explains the rider’s benefits, conditions and exclusions. These are the top 3 things to note when you are looking through a Participating policy illustration. If you have any questions about your policy illustration, feel free to drop us an email at [email protected] or Whatsapp us.

If you are keen to get a quote for NTUC Income’s Gro Power Saver and get a 55% rebate on the first year basic commission, leave your details here!

This is for general information only and does not constitute financial advice. This advertisement has not been reviewed by the Monetary Authority of Singapore.