As the name goes, the Supplementary Retirement Scheme (SRS) is designed to help Singaporeans save for retirement. On top of enjoying tax relief, the next thing you should do after contributing to your SRS account is to invest your funds! As you steadily reap the returns of your investments, you can grow your nest egg continuously as you continue working hard at your day job.

How can SRS investments grow your retirement funds?

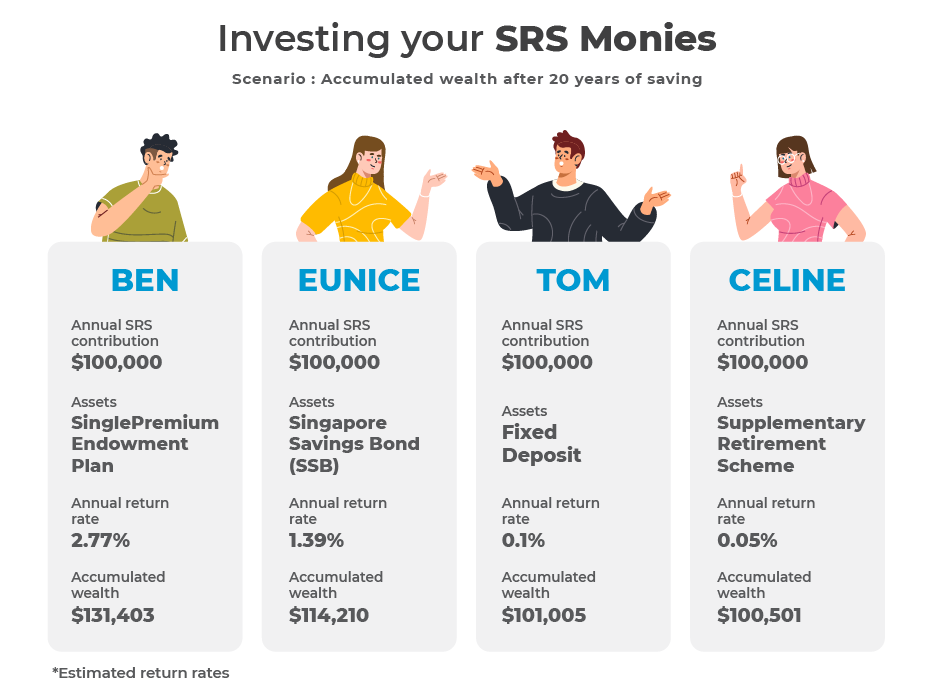

Investing your SRS funds is extremely important if you’re trying to grow your wealth for retirement. This is because SRS funds will only earn a meagre 0.05%p.a. return, when uninvested. This rate is much lower than inflation, which means your uninvested SRS funds will be worth less in the future when you eventually retire.

Another benefit about investing using your SRS funds is that your returns are tax-free, until you withdraw them. This means that regardless of how much you earn from your investments using your SRS funds, you will not be taxed yet, until you decide to withdraw them. And you’ll even have a 50% tax concession if you withdraw your SRS funds upon reaching the statutory retirement age.

Read more about What You Need to Know about Withdrawing From Your SRS Account here.

That’s why, whether you have a high risk tolerance, or prefer safer options, there are multiple investment options for you to grow your funds using your SRS funds. As you continue investing and reinvesting your returns, you can also leverage on compound interest to build your retirement funds!

Let’s look at this example of Ben, Eunice, Tom and Celine’s SRS fund projection, with a single contribution of $100,000:

In fact, Ben could consider investing in a longer term single premium endowment plan for a potentially higher return. For example, after 40 years, the accumulated wealth may grow to $434,645* with an estimated annual rate of return of 3.74%*.

*Estimated returns/benefits for the above single premium endowment plan include both guaranteed and non-guaranteed returns/benefits based on 4.25% p.a. illustrated investment rate of return of the Life Participating Fund.

**Estimated return for SSB is the average return p.a. for 10-year SSB bond issued in Oct 2021. Citibank board rate for a 12-month tenure in October 2021.

^https://eservices.mas.gov.sg/ssb/calculator?bondName=SBOct21%20GX21100W

#Assumed that FD maturity payment after 12-month tenure is reinvested at the same board rate for subsequent 12 months over a 10-year period.

So here’s what you can invest with your SRS funds:

To understand what investments suit your goals – check out this article instead.

1. Fixed Deposits

Fixed deposits are the best investment vehicle if you want fixed and guaranteed return. With fixed deposits, you will know how much returns your funds will generate, and when you will get your funds and interest back. You also won’t have to bear any risk of losing your money.

Another benefit of fixed deposits is that if you need to use your money urgently, you can withdraw the money any time, without losing your capital, although there may be some early withdrawal penalties.

Of course, the lower the risks, the lower the returns. Fixed deposits typically offer only 0.05% p.a. to around 0.5% p.a. returns for new placements. The higher end of this range is usually available for a limited promotion period only.

2. Singapore Savings Bonds (SSB)

SSB is another popular option among Singaporeans, as it typically offers a more attractive return, as compared to fixed deposits. When you purchase SSB, you’ll receive interest payments every 6 months, which will be credited to your SRS account.

The interest rate of your SSB will increase, the longer you hold it, for a maximum of 10 years. Should you need to withdraw your money from SSBs at any point during the 10 years, you can safely do so without losing your principal.

While SSB offers better interest rate as compared to Fixed Deposits and SRS, and is a relatively safe option, its interest rate will fluctuate depending on when you purchase it. For example, if you purchased SSB in July 2022, your 10-year average return would be 2.71% per year, while if you purchased in August 2022 offers a 10-year average return of 3% per year. So, it really depends on when you purchase it.

3. Endowment Insurance Plans

Endowment insurance plans are an extremely popular investment option among savvy SRS fund investors. This is because endowment insurance plans offer relatively higher returns while still being low risk. Endowment plans are investment plans that come with life insurance, and offer guaranteed and non-guaranteed interest, typically around 3-4% p.a., which is higher than fixed deposits and SSB. Most endowment plans are also capital guaranteed by the Singapore Deposit Insurance Corporation (SDIC), under the Policy Owners’ Protection Scheme.

Endowment plans are uniquely designed to help investors maximise their investments, while avoiding unnecessary risks. They include both guaranteed benefits and annual bonuses or cash dividends that depend on the performance of the insurer’s participating funds. These annual bonuses or cash dividends are non-guaranteed, but will become guaranteed additions to the death and maturity benefits, once they are announced during the policy term. On top of that, some endowment plans, such as MyLifeIncome III, also provide yearly cash dividends after a certain accumulation period.

You can also withdraw your SRS funds from your endowment plan anytime, if there is an emergency and you need to withdraw your funds. Do note that like fixed deposits and SSB, there might be charges for early withdrawal.

Interested to invest your SRS funds? Click here or contact us to know more about SRS-approved endowment plans.

4. Blue Chip Shares

Blue chip shares are equities of well-established and typically financially sound corporations that have been operating for many decades. You have the option to purchase these shares on the Singapore Stock exchange using your SRS funds (except American Depository Receipts).

However, it’s important to remember that while an organisation has been around for some time, it doesn’t mean that it is infallible. While blue chip shares may potentially provide you higher returns, there are also many more things at stake. If you’ve done your research and are willing to take risks, that’s great. If not, are you willing to stake your retirement funds on stocks that are subjected to market fluctuations?

5. Unit Trusts

If you want to reap the returns of stocks, but also want to reduce your risks, you can consider investing in unit trusts. Unit trusts are like a diversified basket of multiple stocks, actively managed by a fund manager, in return for a fee.

Fund managers are professionals who pick stocks that they believe have strong potential to grow, and sell stocks at the right timing to earn. Good fund managers with expertise and experience aim to beat the market, with higher than average returns. That’s why it is important to pick a good fund with experienced and competent fund managers, who can help diversify your risks, while maximising your returns.

At InvestDIY, our Star Rating System takes the guesswork out of investing. All our funds are designed to diversify your portfolio, while providing growth opportunities, and are professionally managed by Black Rock, J.P. Morgan, PIMCO and other top global fund managers. Depending on your investment goals and risk profile, you can invest in investment grade securities or thematic funds, and earn up to 12.12% p.a. in 5 years.

Interested to invest your SRS funds in unit trusts? Click here or contact us to learn more about how you can maximise your SRS returns with unit trusts.

6. Index Funds and Exchange Traded Funds (ETFs)

Index Funds and ETFs are quite similar to unit trust – they are a basket of different equities, such as precious metals, but are passively managed. This means that no one actively monitors or manages the funds. These funds usually have a theme, such as equities, bonds, equities and bonds, commodities, precious metals or originating from a specific country.

Index funds are also commonly tagged to a benchmark, such as the Straits Times Index (STI), which is the benchmark index of the Singapore stock market.

7. Real Estate Investment Trusts (REITs)

REITs are companies that own and usually operate real estate, producing income through rental. Real estate owned by REITs can range from office buildings, hospitals, residential areas, hotels and shopping centres.

However, with the Covid-19 pandemic, and the rise of eCommerce, there seems to be a decline in rental yields in recent years. So do your research before investing in a REIT.

As a conclusion, investment options 4-7 have higher market volatility and may cause you to lose part of, or all of your capital. If you’re uncomfortable with this, options 1-3 would be a better investment method for you.

Regardless of which option you want to invest your SRS funds in, you should make your investment decisions based on research and risk appetite. A right investment decision can help you maximise your SRS fund’s return, but a wrong decision may cost you your retirement fund.

Need help or advice on how to utilise your SRS funds to make it work for you, feel free to contact us or Whatsapp us at +65 9151 5963 (Mon to Fri: 9am – 5pm).

This is for general information only and does not constitute financial advice. This advertisement has not been reviewed by the Monetary Authority of Singapore.

1 All return figures and other statistics shown above are for illustrative purposes only as past performance are not indicative of future performance or results. Actual returns will vary greatly and depend on various factors and involves risk. It is important to note that the capital value of investments and the income from them may go down as well as up and may become valueless. Some of the statements contained in this website may be considered forward-looking statements which provide current expectations or forecasts of future events. There is no assurance that the conditions described in this website will remain in the future and actual results may differ materially.