What is a Supplementary Retirement Scheme (SRS)?

Unlike the Central Provident Fund (CPF), SRS is a voluntary savings scheme that is a part of the government’s initiative to complement CPF and encourage Singaporeans to save more for their retirement.

Individuals can contribute to their SRS accounts by cash only, but their contributions are eligible for tax relief, subject to a limit. SRS contributions can also be invested in SRS-approved investment instruments for faster growth. There is no fixed contribution rate as it is entirely voluntary; you can contribute any amount of your preference to your SRS account.

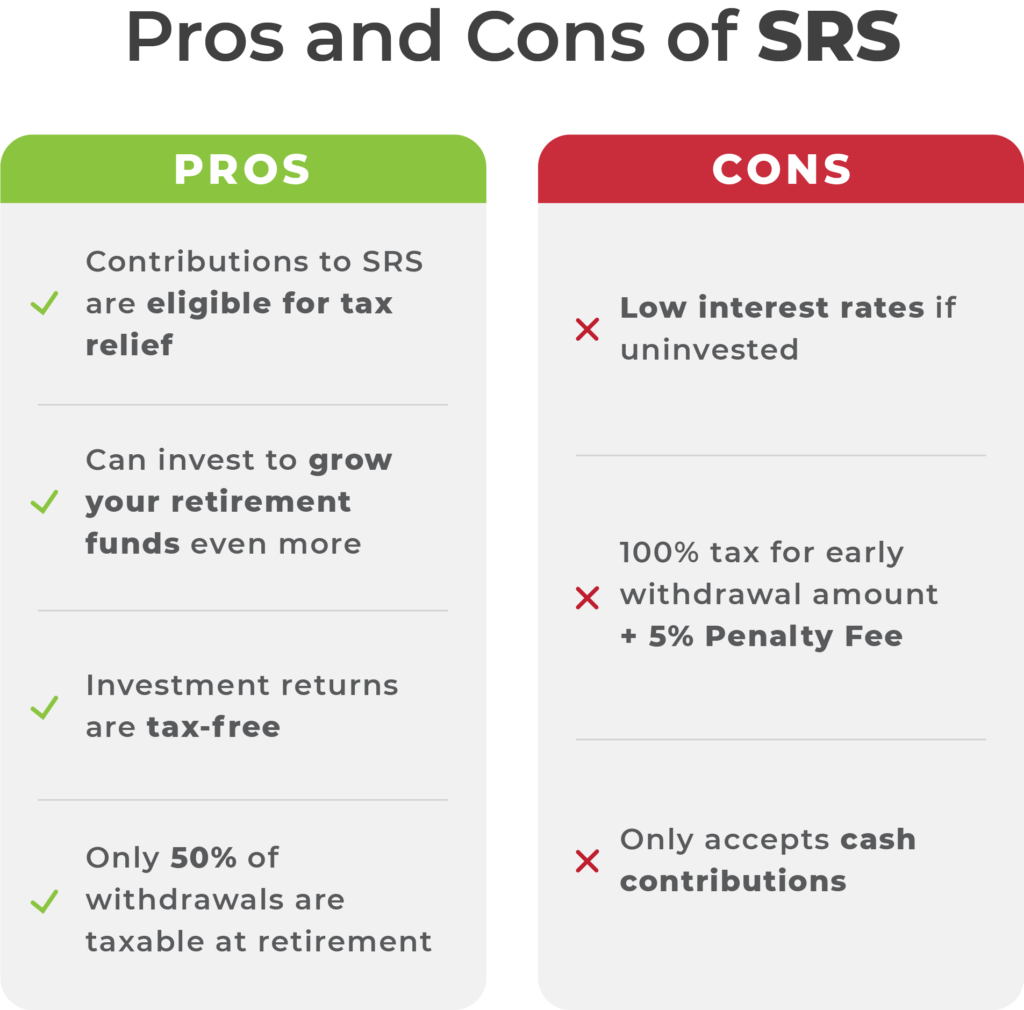

Not sure whether you should have a SRS account? Check out all the pros and cons of contributing to SRS:

Advantages of Contributing to a SRS Account

1. Contributions to SRS are eligible for tax relief

With so many different retirement investments available in the market, why do many Singaporeans still choose to create a SRS account? Because of tax benefits!

For each dollar you contribute to your SRS account, it will contribute towards your tax relief in the following year of assessments, up to $15,300 for Singaporean and Permanent Residents, or $35,700 for foreigners.

The tax benefit is extremely attractive if you would like to reduce your chargeable income, as your income bracket determines your payable tax amount each year. You’ll notice that there’s a considerable increase in amount payable once your annual income passes the $40,000 threshold.

From YA 2017 onwards

| Chargeable Income | Income Tax Rate (%) | Gross Tax Payable ($) |

| First $20,000 Next $10,000 |

0 2 |

0 200 |

| First $30,000 Next $10,000 |

– 3.50 |

200 350 |

| First $40,000 Next $40,000 |

– 7 |

550 2,800 |

| First $80,000 Next $40,000 |

– 11.5 |

3,350 4,600 |

| First $120,000 Next $40,000 |

– 15 |

7,950 6,000 |

| First $160,000 Next $40,000 |

– 18 |

13,950 7,200 |

| First $200,000 Next $40,000 |

– 19 |

21,150 7,600 |

| First $240,000 Next $40,000 |

– 19.5 |

28,750 7,800 |

| First $280,000 Next $40,000 |

– 20 |

36,550 8,000 |

| First $320,000 In excess of $320,000 |

– 22 |

44,550 |

For example, if your chargeable income was $40,000 last year, you will be required to pay $550 for income tax, according to the table above. This year, let’s say you changed your job and are getting a higher pay, with a chargeable income of $54,000 annually. You’ll have to pay $1,530 for income tax next year, which is almost triple the amount of income tax you were paying last year.

However, if you invested the additional $14,000 of your pay raise into your SRS account, you will reduce your chargeable income back to $40,000 annually, bringing your income tax down to $550 like last year, although you’ve earned much more!

That’s $980 worth of taxes saved.

2. Can invest to grow your retirement funds even more

On top of getting tax benefits, you can also grow your retirement funds with your SRS account. Do you still need a SRS account if you already have CPF?

That depends. Retirement will probably be one of the largest expenses in your life, considering that you will be spending but not working. As CPF is an involuntary savings scheme, it is designed to only give you a basic retirement income – enough for basic survival, but not enough if you want to travel or live a more comfortable lifestyle. This is especially true if you are also planning to buy a home with your CPF.

That is why your SRS account is designed to help you prepare for your retirement through investments, as opposed to normal savings accounts and CPF. By investing your SRS funds into various SRS-approved instruments, such as Fixed Deposits, Singapore Savings Bond (SSB), or Single Premium Insurance Saving Plans, you can passively earn better returns that can beat inflation.

3. Investment returns are tax-free

Investments are crucial to grow your retirement funds, especially because uninvested SRS funds will only provide a return of 0.05% p.a.. That’s why it is strongly recommended to invest your SRS funds. You can invest based on your risk tolerance or preference to a variety of options, from higher risk investments, such as blue chip stocks or unit trusts, to safer options like SSB or Single Premium Insurance Saving Plans.

The best part is that any returns earned through your SRS investments are tax-free until you withdraw them. This means that, regardless of how much you earn through investments using your SRS funds, you will not be taxed, until you decide to withdraw it. In order to maximise your SRS savings, you should invest and reinvest your returns – use compound interest to your advantage to grow your retirement fund!

4. Only 50% of withdrawals are taxable at retirement

As your retirement fund grows exponentially throughout the years of compounding in your SRS account, once you reach the retirement age of 62 years old and decide to withdraw your SRS funds, only half of the amount you withdraw will be subjected to tax.

In other words, if you withdraw $40,000 a year, only $20,000 is subject to income tax. However, since you do not have any other chargeable income, you will fall under the tax-free bracket. Meaning, you will be able to withdraw $40,000 without paying any tax for your retirement.

Disadvantages of Contributing to SRS Account

1. Low interest rates if uninvested

As mentioned, SRS accounts have low interest rates of only 0.05% p.a. if you leave it unattended. In this case, it would be better for you to keep the money in your bank, instead of tying it up in your SRS account. However, this low interest rate is an optional disadvantage – you can choose to invest the money instead in investment instruments with higher returns.

For example, if you choose to invest your SRS funds into a Single Premium Insurance Plan with 3.74% p.a. guaranteed interest, you will be able to earn more than if you invested in Fixed Deposits or SSBs!

2. 100% tax for early withdrawal amount + 5% Penalty Fee

SRS contributions once made, cannot be refunded. There is a withdrawal age limit for SRS funds, that is denoted by the official statutory retirement age when you make your first SRS contribution. For example, if you open your SRS account now, early withdrawal will be defined as any withdrawals made before you are 62 years old.

While you can withdraw from your SRS account anytime, 100% of your withdrawal amount will be taxed, and you will also incur a 5% penalty. This could potentially eliminate the tax benefits that you gained previously. Under special circumstances, such as medical reasons, bankruptcy or if you pass away, you can withdraw without paying the penalty.

3. Only accepts cash contributions

You can only use cash to make contributions to your SRS account. This might be a slight disadvantage of SRS as some investors would prefer to take advantage of low interest rates to finance their retirement investment funds.

Planning for retirement is no easy feat, and maintaining your SRS account takes careful considerations to maximise the tax benefits and reap investment returns to grow your nest egg.

Check out our SRS-approved investment products or contact us to learn more on how to maximise your SRS returns today!

This is for general information only and does not constitute financial advice. This advertisement has not been reviewed by the Monetary Authority of Singapore.