Index Universal Life (IUL) insurance offers a unique combination of life insurance and growth potential, appealing to many Singaporeans seeking flexibility and financial security. This article explores the basics of IUL and its relevance to Singapore’s evolving insurance landscape.

What is Index Universal Life Insurance?

IUL is a type of permanent life insurance policy that combines a death benefit with an investment component. A portion of your premium is allocated to the policy’s cash value, which can grow based on the performance of a market index, such as the S&P 500 or Hang Seng Index. This setup provides a way for policyholders to participate in market growth without directly investing in equities.

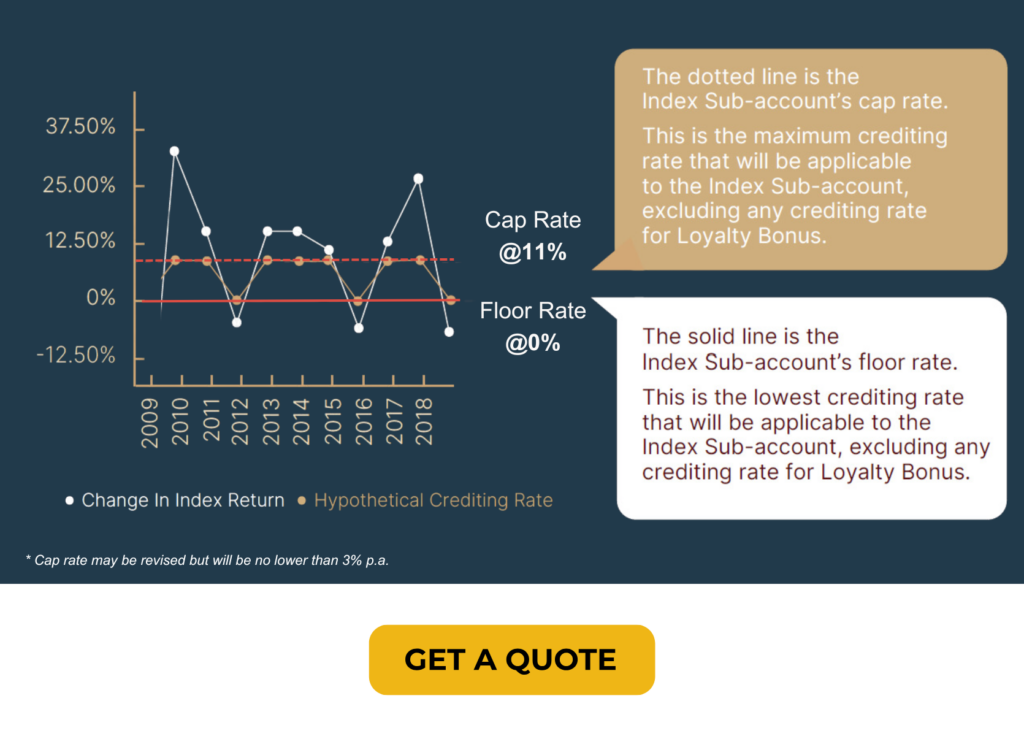

Unlike some other investment-linked insurance plans, IUL offers protection against market downturns through a guaranteed minimum interest rate. This feature ensures your cash value remains protected, regardless of index performance. At the same time, the potential for growth based on index performance allows your cash value to increase over time, providing an attractive balance of security and opportunity.

Check out our diagram showing the floor (downside protection) and caps of Singlife’s Legacy Index Universal Life plan below.

Why Consider IUL in Singapore?

IUL insurance is becoming increasingly relevant in Singapore due to the country’s rising interest in financial products that offer both protection and growth potential. Many Singaporeans value flexibility in their financial planning, and IUL policies allow adjustments in premium payments and death benefits over time. This makes IUL an excellent choice for individuals whose financial circumstances may change, such as young families, business owners, or retirees looking to enhance their financial security.

Singapore’s sophisticated and well-informed financial environment means that residents often seek insurance products that integrate with their overall wealth-building strategies. IUL offers the potential to grow wealth by linking the policy’s cash value to major market indices, providing policyholders with opportunities to benefit from the upside of financial markets.

Flexibility in Financial Planning

One of the most appealing features of IUL policies in Singapore is the flexibility they provide. You can adjust premium payments and even the death benefit as your financial needs evolve. This makes IUL an excellent fit for long-term financial planning, as it allows you to increase or decrease coverage as needed, without having to purchase a new policy.

Moreover, the ability to participate in index-linked growth means that your policy’s cash value can increase in line with the market. This provides a compelling option for those who want to enhance their financial security over time.

Conclusion

Index Universal Life insurance offers Singaporeans a unique blend of life insurance protection and growth potential. With its flexible premium options, ability to link the cash value to market indices, and the guaranteed protection against downside risk, IUL is an attractive option for those looking to balance protection with long-term financial growth. As with any financial product, it’s important to understand how IUL fits into your overall financial strategy, get a quote here and our adviser will follow up with you.